We fund and build the future.

Prototype Capital's mission is to build lasting 100-year businesses by

selling revolutionary products that solve difficult problems,

mostly by overcoming challenging engineering obstacles.

We're all founders building companies and investing in them.

Our Manifesto

“The future” is fast approaching. What we thought was impossible five years ago is quickly becoming possible: cars are driving themselves, robots are keeping the elderly company in Japan, quadrotors are using computer vision to analyze crops yields in the midwest, CRISPR-cas9 can edit genes just like we’d edit a word document, and deep neural nets can identify tumors more accurately than the very best radiologists.

Unlike the “purely” software and SaaS companies we’ve seen in the first two decades of the millennium, it seems like this “Third Wave” of startups, as AOL Founder Steve Case calls it, will differ quite radically:

- Instead of purely software applications that a college student can develop in a dorm room with no capital, it’s becoming increasingly important to actually sense and then actuate on the physical world. This requires hardware which necessitates prototype capital, longer timelines to launch, and more expertise to get started.

- This next generation of technologies will disrupt entrenched and heavily regulated industries like healthcare/medicine, finance, agriculture, and transportation. More than ever, startups can’t simply ignore the government or larger corporations -- instead, it’ll become more important than ever for agile startups to work with governmental organizations and Fortune 500s to innovate.

- Perhaps the most notable difference though is that this next generation of startups might not only arise in Silicon Valley. For the last twenty years or so, software was really eating the world as Marc Andreessen quipped, and it was not uncommon for a group of software engineers and serial entrepreneurs who knew nothing about the taxi industry (e.g., Uber) or e-commerce (e.g., eBay) or the financial industry (e.g., PayPal) to completely disrupt the industry.

But now in a world where information/data is king and where the all the algorithms for machine learning are open source, it’s less about what algorithms you’re using, and instead more about what data you have access to and what application you’re applying the algorithms to. In this case, domain level expertise is extremely important; in other words, it probably won’t be a 30-year-old male engineer who graduated from an Ivy League school, lives in San Francisco, and ran an e-commerce company in a past life who will create the next billion dollar AgriTech company. Instead, it might be the state school educated son of a farmer who lives in the midwest, really understands agriculture, and who has access to tremendous amounts of data about his crops.

Currently, most VCs are looking for startups in metropolises like Silicon Valley and New York. The kicker is that they’re doing nothing wrong--because of network effects and a prior knowledge base of “how to do it,” places like Silicon Valley have been by far the best place to startup so every founder wants to go there. But the world is fundamentally changing.

Once we find great companies through our partner network, we’re going to do everything in our power to help them succeed and to counter the intrinsic economic changes we’re seeing. For example, because of the fundamental necessity of startups and Fortune 500s to work together in this next wave, we’re going to host quarterly Corporate Connect days where founders can pitch and build relationships with Fortune 500 corporations and governmental organizational leaders like DARPA / FDA / FAA for future partnerships, funding, purchase orders, or even potential acquisition targets.

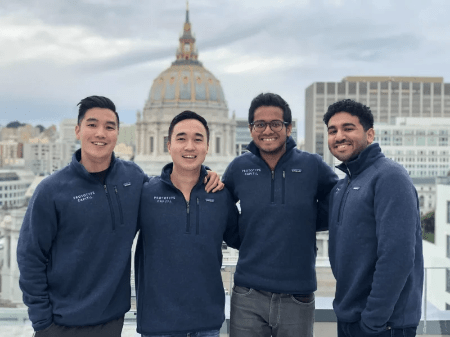

And equally important, our partners are going to get down in the trenches to help founders succeed. These days it seems like every seed/pre-seed fund offers “advisors” but something we noticed when founding our own companies is that oftentimes these relationships are aloof monthly ordeals. With Prototype Capital, our managing partners Nandeet and Rajat are both founders who understand the intricacies of building companies since we've done it before and will be on call 24/7 to help make day-to-day decisions like “which engineer do I hire” or “how do I effectively hold meetings.” Similarly, our venture scouts -- also successful founders -- will contribute a set number of hours of design/engineering/recruiting work each week.

Founders are really the fountainheads of innovation and we’re dependent on them to push our world forward. We’re excited to not be “just another fund” but rather an organization of people working to build the future along with founders.

Here's why you should work with us

"You're the only investor I've had who actually calls to help out and do work not just ask for updates"

~ Jiren Parikh, CEO at Ghost Robotics

We spend most of our time advising

After exiting a company in the past, we've learned that money is cheap but good guidance is hard to come by. We're here to help you make the tough decisions as "Virtual CEOs." We really want to be your co-founder on demand and help you make tough decisions at 3 AM when the going gets tough:

- decide which engineer to hire,

- how to hold meetings effectively,

- how to make decisions at scale,

- how to hire an executive,

- how to run interviews,

- how to fire an employee,

- how to do enterprise sales,

- help you raise your next round,

- decide whether to sell

How we help you succeed

We pride ourselves in getting down in the trenches with founders

- Once you're our portfolio company, we will do everything we can to help you raise your Series A

- We have a team of "experts in residence" who will put in day-to-day time into your company

- Our writer in residence will write any and all blog posts, case studies, and copy you want

- Our social media expert in residence will manage all your social accounts

- Our marketer in residence will create and execute a branding strategy from scratch for your company

- Whenever you're looking to hire, our team will help you find, recruit, and sell the very best talent on joining

- You get access to the massive network (below) of all our partners, scouts, team members, and advisors for connections to fundraise, hire, and partner

- We help our portfolio companies partner with corporations via our Corporate Connect Program

- We connect you with advisers who have vested interest and aren't just on the web page for the sake of it

- We provide guaranteed press opportunities (i.e., TechCrunch, Forbes, HuffPost, StartupGrind)

- Over $200k in free access to products from our partners like Amazon Web Services credits

- We're currently working to provide pro-bono legal and accounting work

Our Advisors and Partners Were Raised In Success

Here's the network you can access, anytime, anywhere

Our Partners

We provide over $200k in free services to our portfolio companies

We Connect You with Corporations

To change the world, large corporations and agile startups need to work together.

We're here to help make those partnerships possible.

How it Works

1) Once we invest in your company, we work together to select five Fortune 500s in our network that your company has the most synergies with.

2) We'll set up a virtual first round demo day with a VP or higher at each corporation where you can pitch your product

3) If there's mutual interest, we'll host a second of round interview with that partner to discuss details of how the two parties could work together.

4) Once both parties are excited about pursuing further, Prototype will fly the founders over to the HQ of the corporate to meet and pitch other key stakeholders in the corporation.

How we invest

We generally like to chip in follow-on capital (usually $100k or less) and don't usually take board seats. Most of our value isn't in the cash we provide but rather our mentorship, our connections, and the sleeves-up time we spent working day-to-day. We're interested in any company building a product that's better than the status quo by 10x but spend most of our time looking into the following spaces:

- Robotics

- Machine Learning for X

- Digital Health

- AR and VR

- Hardware and IoT

- Consumer and Enterprise Software

- Consumer Packaged Goods

We are distributed

The next great innovation in AgriTech is more likely to come out of Idaho than San Francisco

We believe that there are great entrepreneurs outside of just places like Silicon Valley. To help empower them and help build the ecosystem in more recently developed startup hubs, our fund has a decentralized structure with partners at universities and cities around the nation.